Stability Systems

Tools and frameworks for building calm, resilient financial lives.

Stability Systems are not about earning more, budgeting harder, or chasing quick wins.

They are about design.

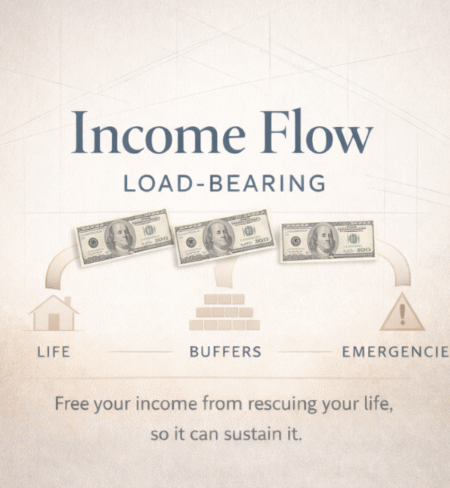

This category exists because most financial stress is not caused by lack of effort, but by lack of structure. When money is asked to do too many jobs at once like support daily life, absorb emergencies, fund the future, and protect others.

The pressure builds.

Stability Systems help you:

See how your money is actually being used

Separate money by role

Design buffers that absorb shock protect growth before pursuing more of it

These tools are built for real life where income fluctuates, responsibilities are shared, and change is inevitable.

Inside this category, you’ll find:

The Financial Stability Map™, our foundational orientation framework

Zone Guides that help you navigate specific structural challenges

Systems for emergency funds, income flow, and buffers

Family-focused tools that prioritize calm and clarity over fear

-

-

-

-

-

-

-

Savings Buffer (Shock Distribution) Diagnostic Level Three v.1

0$3.00Not every surprise is an emergency.

This shows you why they feel like one.Many financial systems collapse under small, predictable shocks like school fees, repairs, annual bills, seasonal expenses etc because there is no layer designed to absorb them.

Savings Buffer: Shock Distribution helps you identify where everyday life is quietly manufacturing emergencies and shows you how to separate predictable costs from true crises.

This diagnostic teaches you how to:

-

Distinguish real emergencies from irregular expenses

-

Stop draining your emergency fund for predictable costs

-

Reduce financial spikes that create stress and decision fatigue

-

Design buffers that smooth life instead of disrupting it

When savings buffers are missing, every surprise feels urgent.

When they are in place, life becomes quieter, even when costs arise.This is not about saving more.

It’s about placing savings where they reduce pressure the most. -

-